[ad_1]

30 June, Kathmandu. Salaried employees will be allowed to deduct up to Rs 5 lakh per year from their taxable income deposited in the Avakas Fund.

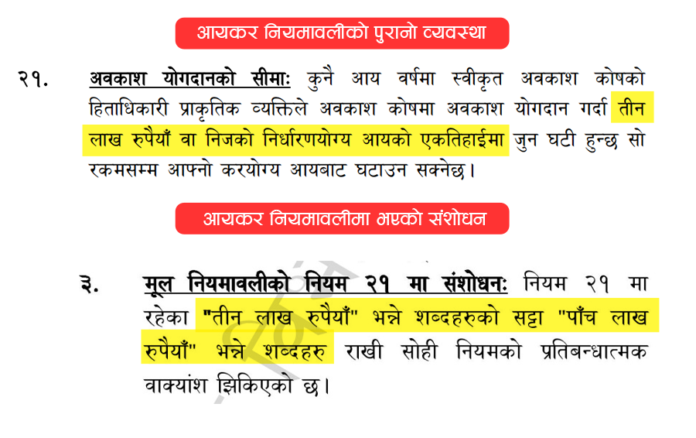

The amendment to the income tax rules announced by the government on Wednesday has made such provision. Earlier, there was a provision to reduce this amount up to 3 lakhs per annum.

This means that up to 41 thousand 666 rupees per month can be deducted from the taxable income by keeping up to Rs.

According to this, taxpayers who earn up to 1.5 lakhs annually will keep 5 lakh rupees in the housing fund and reduce it to pay income tax of only 10 lakhs.

The government has amended the Income Tax Regulations and provided that the annual contribution to the housing funds can be deducted from the taxable income up to 5 lakh rupees or one-third of the taxable income, whichever is less.

Earlier, if you put up to 25 thousand rupees per month in the housing fund, you get tax exemption, but now this amount has reached 41 thousand 666 rupees.

However, those with an annual income of less than 1.5 million will be allowed to deduct only one-third of their total income from their taxable income out of the amount deposited in the retirement fund.

The government has been levying income tax in different slabs ranging from a minimum of 1 percent to a maximum of 39 percent depending on the taxpayer’s income.

That is, the taxpayer can reduce the amount of contributions made to employee provident fund, citizen investment fund, social security fund and other approved development funds operated by companies in the total taxable amount.

In addition, through the amendment of the Income Tax Regulations, the limit on which the taxpayer can match the expenses incurred in treatment has also been increased. Previously, there was a provision for tax matching up to 750 rupees for medical expenses, now it has been doubled to 1500 rupees.

[ad_2]