[ad_1]

30 June, Kathmandu. Although the Internal Revenue Department has corrected the format of the form developed to claim the concession given by the Economic Bill, it has only partially corrected the error in it.

The news that the form created to claim the benefits given by Sections 22 and 23 of the Economic Act has reversed the Economic Bill itself Online newsAfter publishing it, the department corrected the form and put it on the website on Wednesday.

However, the partially corrected form is still different from the content mentioned in the Finance Bill.

In sub-section (1) of section 22 of the Finance Bill, if a person has earned taxable income in the past but has not obtained a permanent account number, such person should obtain a permanent account number and submit the income statement for the financial years 2078/79 and 2079/80 and the tax payable on the same in 2081. If it is paid by the end of February this year, the fee and interest will be waived.

Similarly, in sub-section (2), it is mentioned that ‘if the income statement and the tax levied in accordance with sub-section (1) are submitted, the income statement of the previous income years and the taxes, fees and interest levied thereon need not be submitted.’

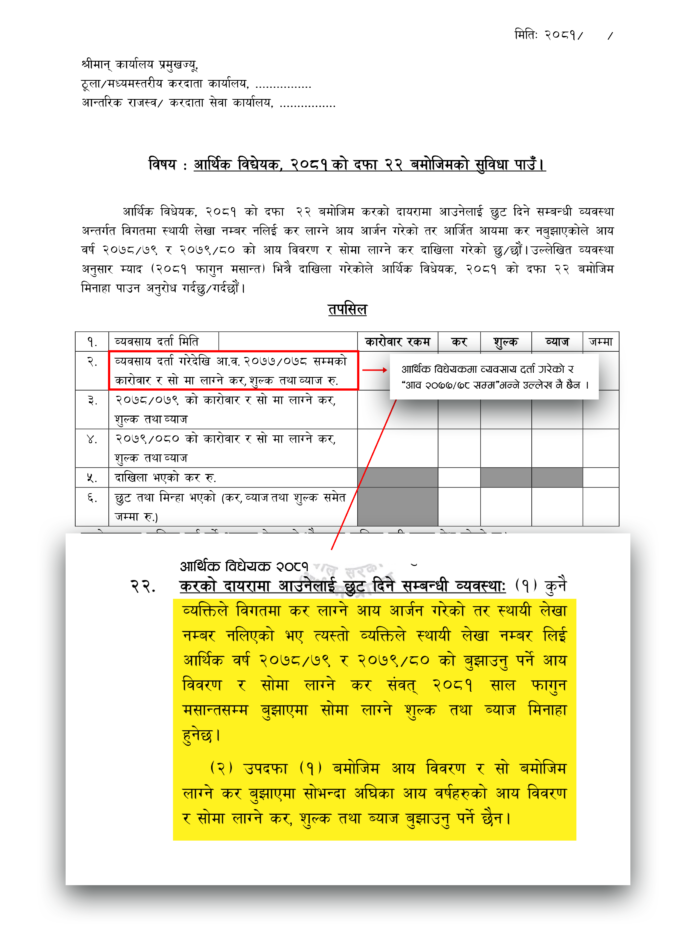

Although it is mentioned that ‘individuals’ will get the facility according to Section 22 of the Economic Bill, it was mentioned in the form that only ‘firms/companies’ will get such facilities. The word ‘person/company’ has been removed from the form.

However, a chartered accountant said that even according to the revised form, other than the taxpayers who have registered their business will not get the facility as per section 22.

It is arranged that the date of business registration should be written in the form. After that, the form has been developed in such a way that the tax, fees and interest charged on the business should be mentioned and the business ‘transactions from the time of business registration to the year 2077/78’ should also be mentioned.

This system has deprived the people who earn income without registering their business from taking benefits.

However, there is a provision in the bill to exempt the income from income tax regardless of whether the business is registered or not.

‘If any company or person has earned personal or business income without taking a PAN number, this provision has been made to bring them under the scope of tax. However, the form again made it seem that only those who have registered a business will be given this facility. However, many professionals including doctors, engineers, lawyers have not taken pan yet and if they go to the tax area now, they would not be able to get it, he said.

In the financial bill, there is no mention of ’till 2077/78′. The form has gone one step ahead of the law and added provisions that are not in the law.

In addition, the error in the form created to implement the facility of Section 23 of the Economic Bill has only been partially corrected by the new form.

As the bill mentions ‘taxpayer pending submission of income statement’, it has been corrected as only ‘firm/company’ was written in the previous form.

Apart from that, the bill does not mention till which year ‘taxpayers who are yet to submit income statement with permanent account number’ will submit their income statement. However, the form mentions the statement of income ‘year 079/80 or earlier’, which is not in the Act itself. This matter has not been corrected even in the new form.

‘Actually, there is an error in the financial bill itself, the bill does not mention when the income statement will not be submitted. It makes sense that if the statement of the current year has to be submitted by the end of October, those who do not do so and submit it by the end of February will also get the facility. It seems that the form is trying to improve it. However, the provisions of the Act cannot be amended by the form, the Act itself must be amended,’ said the chartered accountant.

The details written in the form to implement Section 23 have been corrected so that the tax filed and the interest of 25 percent should also be added. However, the phrase ‘filed tax and 50 percent interest’ mentioned in the form for implementation of section 24 has not been corrected.

According to Section 24, taxpayers who have not submitted their value added tax returns by the end of June 2080 will be required to pay 50% of the total amount of tax and interest if they submit their tax returns. ,’ said the CA on condition of anonymity.

[ad_2]